European utility-scale battery installations “ramping up” as solar cannibalisation bites, Rystad finds

The SolarPower Summit in Brussels last week brought together the European solar and energy storage industry with policymakers and the increasing frequency of zero or negative price events in electricity markets was a major talking point. A combination of increased flexibility of electricity networks along with a rapid ramping of battery storage installations have emerged as the solution.

Analysis from Rystad Energy, presented on the second day of the Summit, laid bare the extent of the challenge posed by the increasing frequency of negative pricing in various European electricity markets. And with German solar installations continuing apace, the development is particularly evident.

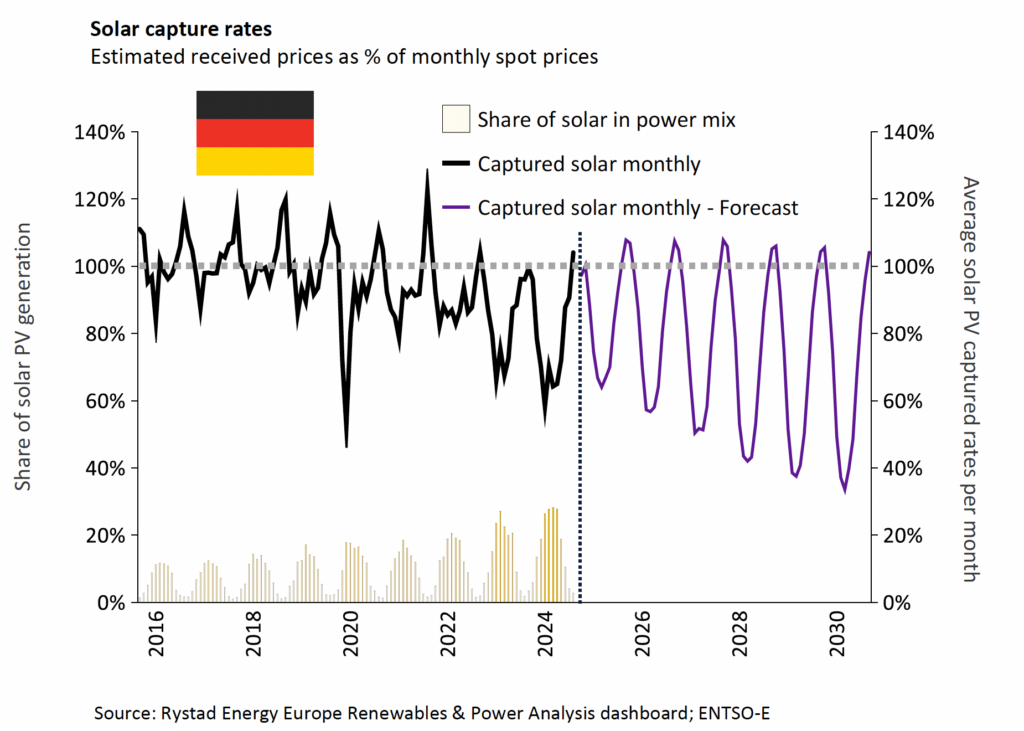

“What we see in Germany specifically is the cannibalisation of revenues for solar and this trend has really accelerated,” Vegard Wiik Vollset, the head of renewables and power, EMEA, for Rystad Energy told ESS News. “And that has come on the back of some massive installations that we’ve seen. Just in Europe alone we installed more than 60 GW of capacity of solar [in 2024]. That has had huge negative impacts in terms of the revenues that these solar assets actually receive just because of this cannibalisation rate.”

Cannibalisation refers to solar depressing wholesale electricity prices during daylight hours due to its low marginal cost.

Vollset said that while ideally suited to address the challenge, battery storage installations are not yet occurring fast enough to relieve this price cannibalisation.

“You could say this [cannibalisation] could be counteracted by batteries. But we are growing four times as much solar as we are batteries every single year in Europe.”

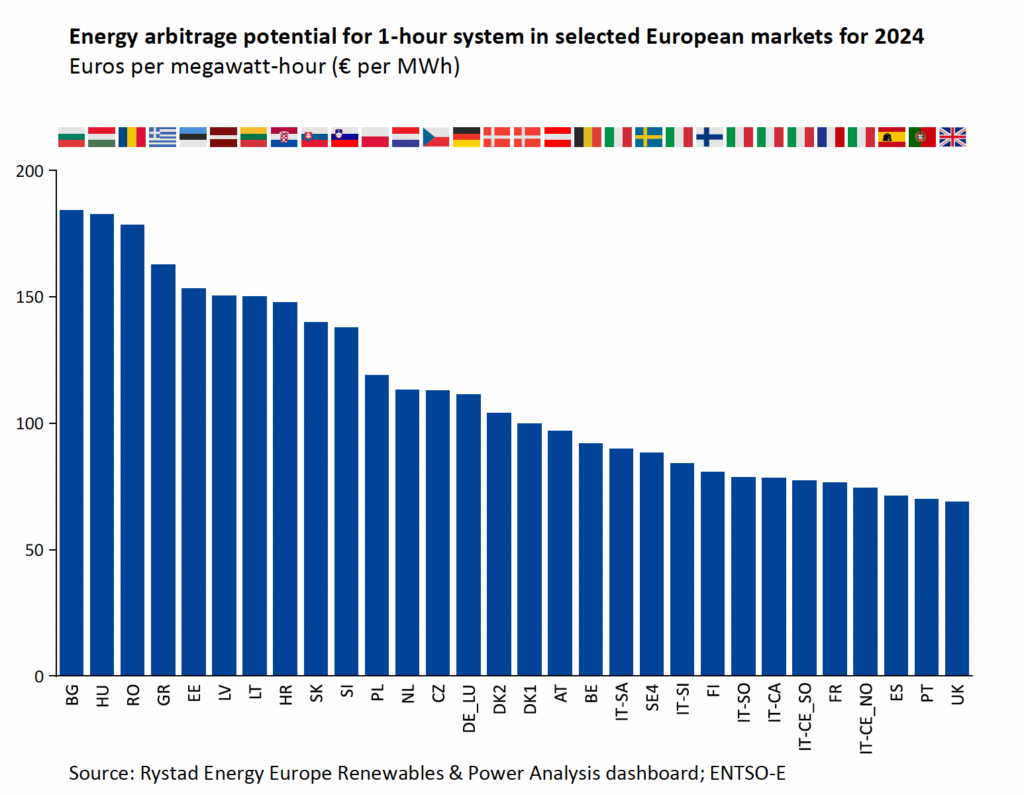

While rapid solar expansion is driving negative price events in Germany, the combination of renewable energy expansion and existing inflexible thermal generation is having a pronounced impact elsewhere. And as a result, the arbitrage opportunity for batteries in this markets are high.

Rystad analysis reveals that in 2024 Bulgaria, Hungary, and Romania had the highest arbitrage opportunity on a euro-per-megawatt hour basis. This is driven by inflexible nuclear or coal generation combined with solar and/or wind resulting in relatively frequent negative price events.

Battery expansion

Given these market signals, renewable energy project developers are ramping up battery installations. “A lot of solar players are really seeing the opportunity space here which is really encouraging,” said Vollset.

In Germany, co-locating battery systems with solar is becoming standard, reported Enerparc co-founder and COO Stefan Müller. “There is not a single PV plant [being developed] without storage anymore,” he said. “This is completely standardised.”

Müller continued that on top of new installations, developers like Enerparc are exploring retrofitting batteries to existing solar arrays.

“We’re trying to retrofit these ‘normal [solar] plants’ with a battery storage system. This is much, much easier with solar in comparison to wind,” said Müller, given that solar sites are much smaller in terms of footprint than sprawling wind installations.

However, Müller noted that the battery project supply chain is not yet as mature as it is in solar.

“For storage, there is a challenge and it starts from finding good EPCs that can install big systems and you also need good engineers to install the plants. You also need people that can speak with fire brigades and think about security. That is a completely different story, storage to PV.”

Falling costs, better regulation

Strengthening the prospects for accelerated battery deployment in Europe are favourable cost developments along with increasingly favourable regulatory frameworks.

Renewable energy investor and the co-host of the Redefining Energy Podcast Laurent Segalen said that he predicts battery system prices to decline at roughly 10% in 2025, after a 20% fall the previous year.

“You have to look at the price of the system, because the battery is one thing but you need put it in a container, with inverters, software, and a fire suppressant system. So, the price of the full system will go down, but not as fast as the cell,” said Segalen. He noted that as system sizes increases, prices become more attractive, also.

“The good news is that regulators are really understanding more [battery] market access. The big question that regulators need to ask themselves is whether they need to intervene or just let the markets do their thing. I believe, let the market play.”

While many things are moving in the right direction, battery installations continue to trail solar meaning that cannibalisation is likely to get worse before it gets better. In Germany, this means that solar capture prices will continue to fall through to the end of this decade, according to the Rystad analysis.

SolarPower Europe announced its new tagline at the 2025 Summit: Solar, Storage, and Flexibility. The industry association also announced a forthcoming energy storage platform, to expand its activities to include energy storage.