TRENTON, N.J. — If taxes are your main concern, then New Jersey isn’t the state for you now, and definitely won’t be the state for you after this year.

Key Points

- Cigarette, alcohol, cannabis, and vaping products face significant tax increases

- New taxes and fee hikes across various sectors aim to raise $1 billion for New Jersey.

- Gaming and luxury property taxes are the largest revenue sources, expected to bring in $719.4 million combined.

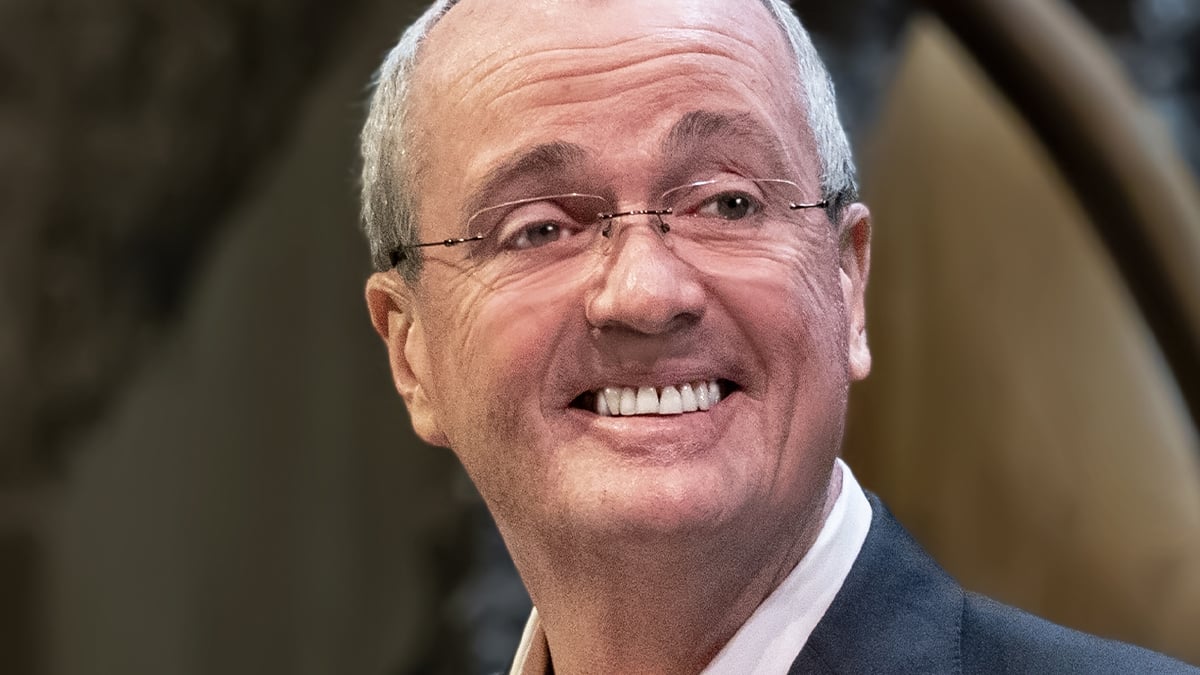

New Jersey Gov. Phil Murphy is proposing more than $1 billion in new taxes as part of his latest budget, targeting a wide range of industries, recreational activities, and consumer goods in a sweeping fiscal overhaul.

Some are calling the new taxes a ‘parting’ gift by the governor to end his two terms in office.

The state plans to raise $277 million through newly applied sales taxes on go-kart racing, laser tag, bowling, digital services, secondhand aircraft, hotel rooms, and even interior design services. The proposed changes also include ending tax breaks on boat sales, including the $20,000 cap and an existing exemption.

Luxury real estate is set to take a significant hit. Homes priced between $1 million and $2 million would see their tax rate doubled from 1% to 2%, while properties selling for more than $2 million would be taxed at 3%, bringing in an expected $317 million.

Murphy is also targeting the gaming and sports betting sectors, proposing a sharp increase in tax rates from 13% to 25% for sports betting revenue and from 15% to 25% for internet gaming. The measure is projected to generate $402.4 million for the state.

Cigarettes, alcohol, and vaping products will face increased excise taxes. A 30-cent hike in the cigarette tax would raise it to $3.00 per pack, generating $41 million. Taxes on alcoholic beverages would increase by 10%, bringing in $18.5 million, while vaping liquids would see their tax triple to 30 cents per milliliter, expected to net $10 million.

Cannabis and hemp product sellers are also being targeted. The Social Equity Excise Fee on cannabis would jump from $2.50 to $15 per ounce. Additionally, a new $30-per-ounce tax on intoxicating hemp products is expected to contribute to a combined $70 million in revenue.

A $2 per truck fee on warehouse-related traffic is expected to raise $20 million, while a new tax on drone sales is projected to add $5 million. An excise tax and increased fees on guns and ammunition would bring in another $8 million, though specifics on those measures have not yet been released.

Murphy’s proposal signals one of the most extensive revenue-raising efforts in recent state history.